In the world of cryptocurrency, having a reliable and secure way to store your digital assets is crucial. This is where a crypto wallet comes into play. Just like a physical wallet is used to store cash and cards, a crypto wallet allows users to securely store, send, and receive cryptocurrencies like Bitcoin, Ethereum, and many others. In this article, we will explore the different types of trustwallet, their functions, and why they are essential for anyone involved in cryptocurrency.

What is a Crypto Wallet?

A crypto wallet is a software or hardware tool that stores the private and public keys required to send and receive cryptocurrencies. It also interacts with various blockchain networks to enable users to check their balance and make transactions. Unlike traditional wallets, which hold physical currency, crypto wallets are digital tools that provide a secure environment for digital assets.

Types of Crypto Wallets

Crypto wallets can be broadly categorized into two types: hot wallets and cold wallets. Both have their advantages and disadvantages, and understanding their differences is essential for choosing the right one for your needs.

1. Hot Wallets

Hot wallets are software-based wallets that are connected to the internet. They are typically used for frequent trading and quick access to cryptocurrency. Some common examples of hot wallets include:

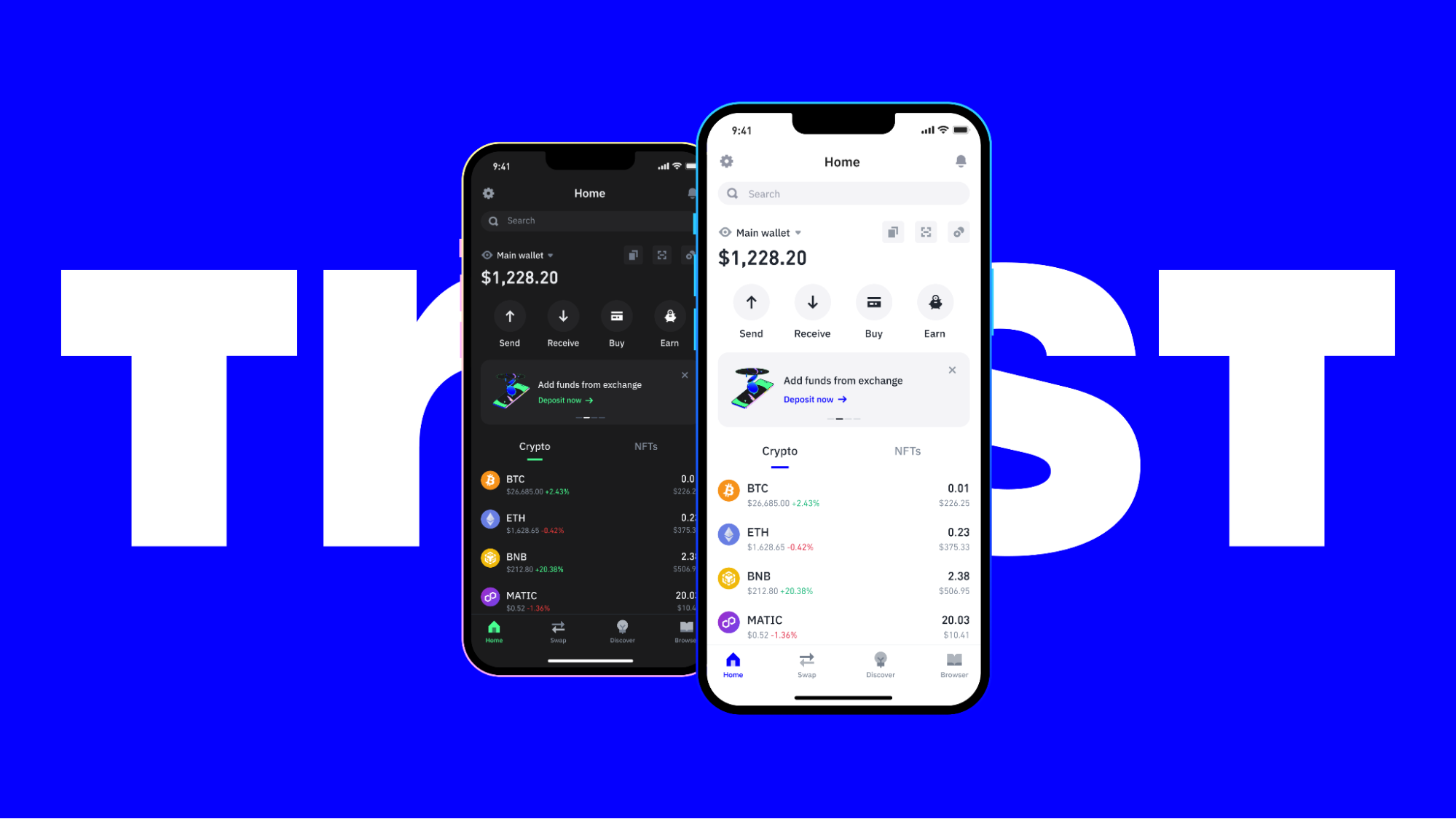

- Mobile wallets: Apps installed on smartphones, such as Trust Wallet or MetaMask, which allow users to easily manage their crypto assets on the go.

- Desktop wallets: Software downloaded and installed on a computer, like Exodus or Electrum, giving users control over their crypto assets directly from their PC.

- Web wallets: Online services, such as blockchain.info, where users can access their wallets through a browser.

Advantages of Hot Wallets:

- Easy access and convenience for frequent transactions.

- Ideal for day-to-day trading and managing smaller amounts of cryptocurrency.

- Support for a wide variety of cryptocurrencies.

Disadvantages of Hot Wallets:

- Being connected to the internet, they are vulnerable to cyber-attacks, such as hacking or phishing scams.

- Less secure for storing large amounts of cryptocurrency.

2. Cold Wallets

Cold wallets are offline storage options that are not connected to the internet, making them more secure from external threats. These wallets are often used for long-term storage of cryptocurrencies. Common types of cold wallets include:

- Hardware wallets: Physical devices, such as Trezor or Ledger, that store private keys offline. These wallets require you to physically connect the device to a computer to access or make transactions.

- Paper wallets: A physical printout of your crypto keys, which can be stored in a secure place. Paper wallets are completely offline but come with the risk of being lost or damaged.

Advantages of Cold Wallets:

- Extremely secure, as they are not connected to the internet.

- Ideal for long-term storage of large amounts of cryptocurrency.

- Protection from hacking or malware attacks.

Disadvantages of Cold Wallets:

- Less convenient for frequent transactions.

- If the device or paper is lost or damaged, the assets can be permanently lost.

How Crypto Wallets Work

Crypto wallets work by storing private and public keys:

- Public Key: This is like your email address. It is shared with others to receive cryptocurrencies.

- Private Key: This is like your password. It is kept secret and used to sign transactions, authorizing the transfer of cryptocurrencies.

When you want to send or receive crypto, your wallet will use the private key to sign transactions, which are then broadcast to the relevant blockchain network. The blockchain verifies the transaction and updates the ledger accordingly.

Importance of Crypto Wallets

Crypto wallets are essential for several reasons:

- Security: The most important function of a crypto wallet is to securely store the private keys necessary for managing cryptocurrency. If you lose your private key, you lose access to your crypto assets.

- Access and Control: A crypto wallet gives users complete control over their cryptocurrency, without relying on intermediaries like banks or exchanges. You can send, receive, and store digital assets at your convenience.

- Privacy: Crypto wallets provide users with a high degree of privacy. Since transactions are pseudonymous, you don’t need to share personal information to send or receive crypto.

Best Practices for Securing Your Crypto Wallet

- Backup Your Wallet: Always back up your wallet’s private keys or recovery phrase. This is essential in case your device is lost or damaged.

- Use Strong Passwords: For software wallets, ensure that you use strong and unique passwords.

- Enable Two-Factor Authentication (2FA): If your wallet supports 2FA, enable it for an added layer of security.

- Avoid Phishing Scams: Be cautious when clicking links or sharing sensitive information. Always double-check the website URL and email addresses.

- Consider a Hardware Wallet for Large Amounts: If you hold significant amounts of cryptocurrency, consider using a hardware wallet for better security.